Why Financial Institutions Need Professional Liquidation Services

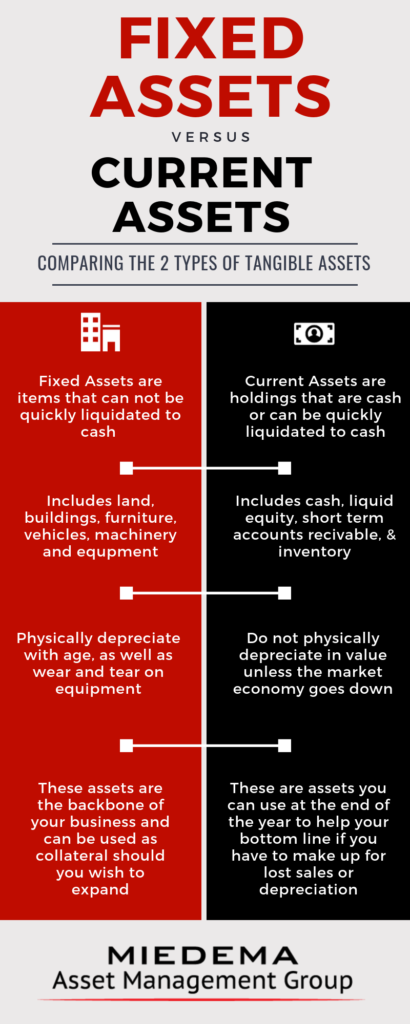

Here at Miedema Asset Management Group, we do a lot of work with financial institutions to conduct auctions across the country. So often banks and other financial institutions quickly need repossessed items liquidated to cash to repay the debt owed to the bank and other parties. Considering the number of repossessed homes, cars, and other forms of property that a bank takes in, it is important that they have a trusted partner that they can turn to that will help them recover their money. That’s where we come in!

Why Financial Institutions Should Partner with Auction Companies:

1. Get the highest selling price possible

Auctions are one of the best ways to get a high selling price. The very nature of an auction is to create a competitive bidding opportunity so that the seller to get the most out of their item. This is great for a bank that is looking to recover as much money as possible from repossessed assets – they will likely get more back than they would with a general sale!

2. Years of Experience

Because we have been in the industry for so long, we have a wide range of experience – selling everything from foreclosed homes to repossessed cars. This experience allows us to position an institution’s property to allow for the best visibility, marketing, and bidders. Experience is extremely valuable in this industry and is imperative for a truly successful auction.

3. Frequency of Auctions

Banks and other institutions typically need their repossessed assets liquidated as quickly as possible to pay the debts owed by the previous owner. Large auction houses host multiple auctions every week – from specific auctions for companies and individuals to general weekly sales (check out our sister company Repocast.com’s auction every Thursday!) that will give banks the quick turnaround they need. If they have enough items to sell, they can hold their own auction with us. If they are only looking to sell a few items they can also choose to participate in a general consigner’s auction. This quick turnaround is perfect when a bank needs to liquidate repossessed assets quickly.

4. Auction Houses are trusted by both sellers and buyers.

When a financial institution partners with a reputable auction house they can rest easy knowing that everything is being taken care of for them. They can trust that auction houses like us know what we are doing – from the selling process to the legal transfers of the items they never have to worry about something going awry throughout the process. It’s the easiest and least stressful way for them to sell their repossessed items.

These are just a few of the great reasons that banks should partner with professional auction houses like Miedema Asset Management Group to liquidate their repossessed assets. If you are a financial institution interested

in partnering with us, contact us here. We want to make your auctions as successful as possible so that you can recover what is owed to you.